Stock Ideas 💡 - 18th June 2024

Stock Ideas handpicked saving you from wasting time and analysis paralysis.

Hello! 👋

Welcome to some interesting stock ideas for this week.

What is Stock Ideas💡 and who is it for? Refer here - Introduction to Stock Ideas 💡

Save the hassle of going through a list of 1500+ stocks and creating a final list of 10-15 stocks also doing fundamental research on the same every single week.

None of the stock ideas are Buy/Sell recommendation as they are no entry or exit prices mentioned.

It is purely for idea generation and prevent mundane screening every week so you can focus on better things.

This series will present you with the best momentum stocks that can be in the traded/ invested from timeframe of few weeks to even couple of months.

United Spirits Ltd

Revenue of 10612 Cr FY23 vs 11321 Cr. FY24 - 👍

PAT of 1126 Cr FY23 vs 1408 Cr FY24 - 👍

EPS of 15.62 FY23 vs 19.36 FY24 - 👍

Looking at the technical standpoint -

Breakout and Retest with good weekly volumes.

DRC Systems India Ltd

Revenue of 26 Cr FY23 vs 48 Cr. FY24 - 👍

PAT of 7 Cr FY23 vs 12 Cr FY24 - 👍

EPS of 0.51 FY23 vs 0.88 FY24 - 👍

Looking at the technical standpoint -

Breaking out of the channel with good volumes.

AVP Infracon Ltd

Good volume in the weekly timeframe.

Revenue of 106 Cr FY23 vs 151 Cr. FY24 - 👎

PAT of 12 Cr FY23 vs 18 Cr FY24 - 👍

EPS of 24.02 FY23 vs 7.32 FY24

Praj Industries Ltd

Beautiful channel formation and price breaking out with some signs of volume.

Revenue of 3528 Cr FY23 vs 3466 Cr. FY24 - 👎

PAT of 240 Cr FY23 vs 283 Cr FY24 - 👍

EPS of 13.05 FY23 vs 15.42 FY24 - 👍

Avadh Sugar & Energy Ltd

Breakout from a falling channel with really good weekly volumes.

Revenue of 2798 Cr FY23 vs 2694 Cr. FY24 - 👎

PAT of 100 Cr FY23 vs 128 Cr FY24 - 👍

EPS of 50.07 FY23 vs 64 FY24 - 👍

InfoBeans Technologies Ltd

Breakout from a falling channel with really good weekly volumes.

Revenue of 385 Cr FY23 vs 369 Cr. FY24 - 👎

PAT of 36 Cr FY23 vs 22 Cr FY24 - 👎

EPS of 14.83 FY23 vs 9.25 FY24 - 👎

Morepen Laboratories Ltd

Following the trendline and breaking out of immediate resistance with good volumes.

Pharma sector is picking up slowly.

Revenue of 1418 Cr FY23 vs 1690 Cr. FY24 - 👍

PAT of 39 Cr FY23 vs 97 Cr FY24 - 👍

EPS of 0.76 FY23 vs 1.88 FY24 - 👍

Mahindra EPC Irrigation Ltd

Breakout of channel in process with highest volumes in last one year

Revenue of 210 Cr FY23 vs 262 Cr. FY24 - 👍

PAT of (12) Cr FY23 vs 2 Cr FY24 - 👍

EPS of (4.39) FY23 vs 0.60 FY24 - 👍

Ponni Sugars (Erode) Ltd

Making a move towards all time high with largest volumes in last one year.

Revenue of 435 Cr FY23 vs 421 Cr. FY24 - 👎

PAT of 38 Cr FY23 vs 47 Cr FY24 - 👍

EPS of 44.59 FY23 vs 54.5 FY24 - 👍

DigiSpice Technologies Ltd

Making a move towards resistance with largest volumes in last one year.

Revenue of 1015 Cr FY23 vs 439 Cr. FY24 - 👎

PAT of (22) Cr FY23 vs 12 Cr FY24 - 👍

EPS of (0.89) FY23 vs 0.50 FY24 - 👍

Asian Granito India Ltd

Breakout from a falling channel with really good weekly volumes.

Revenue of 1563 Cr FY23 vs 1531 Cr. FY24 - 👎

PAT of (87) Cr FY23 vs (20) Cr FY24 - 👍

EPS of (5.74) FY23 vs (0.97) FY24 - 👍

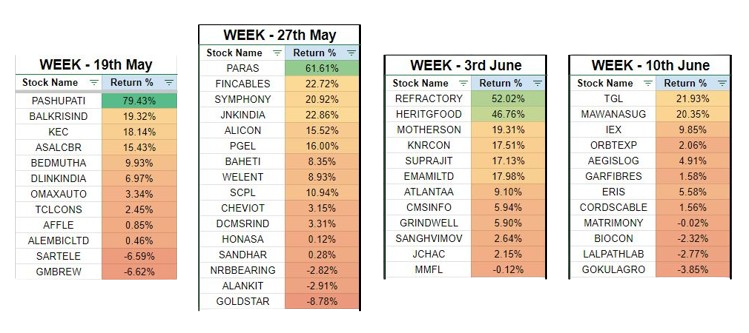

DISCLAIMER : Please note the above is not a Buy/Sell recommendation, it is purely for just knowledge purposes and understanding Technical analysis and the behavior of the market. This newsletter is by no means is to give you calls or recommendations of any kind. Please learn from the above analysis and don’t copy trade. We are not SEBI registered nor a financial advisor. Thank you. Set of Stock Ideas 💡 given last few weeks on 19th May 2024, 27th May 2024, 3rd June 2024 & 10th June 2024 performance have been good in the span of 4 weeks.

Will only keep a record of how it performs on 4 weeks basis.

Great performance by most of the stocks given in the last 4 weeks.

Top gainers being Pashupati (79%+), Paras Defense (61%+), Refractory (52%+)

Top losers being Goldstar (-8.8%) and Sartele (-6.6%)

This is how you can take ideas presented to you, learn how you can mix fundamentals and technical analysis, shortlist and make your own bias.

Will be updating weekly on the performance of the stocks given in the previous week and prior to that.

If you enjoyed reading this, learnt something and have any feedback or insights, please share by leaving a comment below 👇

Thank you for reading and keep learning.

Cheers,

Arjun.

Disclaimer : Content shared on or through this article is for information and education purposes only and should not be treated as investment or trading advice. The analysis and insights presented are based on publicly available information, and while efforts have been made to ensure accuracy, we cannot guarantee the completeness or reliability of the information.

Please do your own analysis or take consultation with a qualified financial advisor before making any investments based on your own personal circumstances.

Investment in securities are subject to market risks, please carry out your due diligence before investing. And last but not the least, past performance is not indicative of future returns.

The author of this post and the platform on which it is published do not provide personalized investment recommendations or financial advisory services. Any investment or trading decisions you make based on the information provided in this post are solely at your own risk.

Neither the author nor the platform shall be held responsible or liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this post. Readers are encouraged to conduct their own due diligence and seek professional advice before making any investment decisions.

By accessing and reading this post, you acknowledge and agree to the terms and conditions outlined in this disclaimer.

Subscribe to Contrarian Portfolio

Deep dive analysis on Indian & US listed stocks, Outlook of the market scenario, Research and Analysis on my picks.