Stock Ideas 💡 - 13 May 2024

Stock Ideas handpicked saving you from wasting time and analysis paralysis.

Hello! 👋

I received a couple of emails asking about the technical analysis on a few stocks and my views on it for positional/swing and long term.

I have decided to revamp the whole ‘Market Pulse’ into ‘Stock Ideas💡’

Stock Ideas💡 - Who is this for?

This article is for every type of investor/trader. If you are an Intraday trader or Swing trader or Positional trader or Long term investor. Suitable for all investment styles.

The difference in time horizon of holding the stock totally depends on personal risk appetite and views.

Stock Ideas💡 - What can you expect from this?

This article will be curated with a bunch of stock ideas for the week which are manually scanned basis on Fundamental and Technical analysis on the stock.

These stock ideas will be filtered from the universe of stocks listed on NSE and handpicked to a very few select stocks that have potential for strong momentum.

Save the hassle of going through a list of 1500+ stocks and creating a final list of 10-15 stocks also doing fundamental research on the same every single week.

None of the stock ideas are Buy/Sell recommendation as they are no entry or exit prices mentioned.

It is purely for idea generation and prevent mundane screening every week so you can focus on better things.

This series will present you with the best momentum stocks that can be in the traded/ invested from timeframe of few weeks to even couple of months.

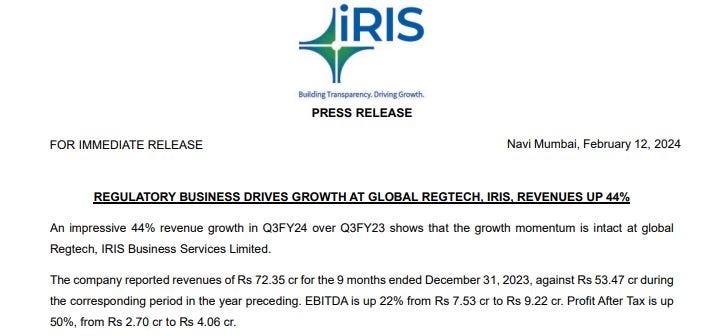

IRIS Business Services

Results come out on 18th May.

Good growth triggers and drivers.

Looking at the technical standpoint of IRIS

Huge volumes picking up.

Broke the all time high with great weekly volume.

Kapston Services Ltd

Breakout after a good consolidation on weekly timeframe.

Volumes picking up supporting the up move.

Great QoQ and YoY performance.

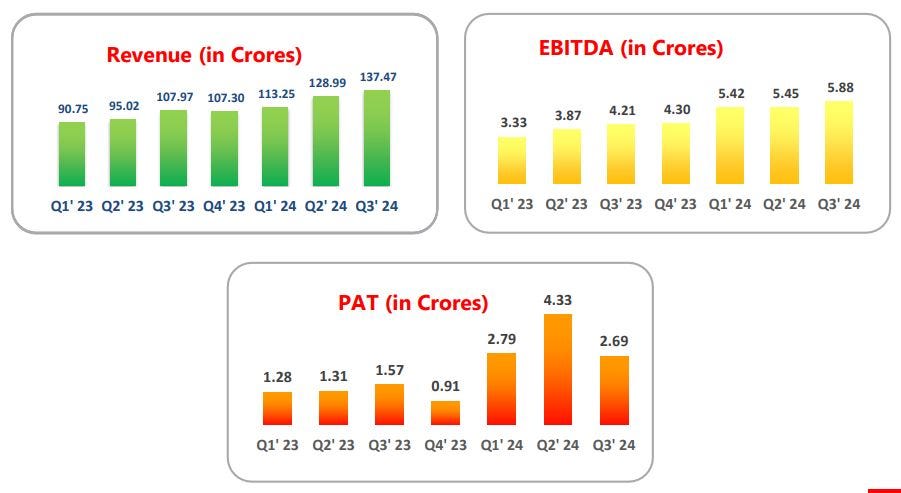

Magadh Sugar & Energy Ltd.

Trendline breakout with good volumes.

Results are out on 17th May.

Great QoQ performance.

Borrowings have decreased

Addictive Learning Technology Ltd.

Good closing above the trendline which has been respected for a 2 whole months.

Sign of good volumes.

Great management, walking the talk.

Revenue of 63.95 Cr FY24 vs 33.54 Cr. FY23

PAT of 6.53 Cr vs 2.47 Cr

EPS of 5.39 vs 2.23

Kay Cee Energy & Infra Ltd.

Weekly volumes building up.

Has around 600Cr Order book. Reporting massive revenue growth.

Operating Margins improving to 18%

Accent Microcell Ltd.

Breakout from a long 2 month consolidation.

Great H1FY24 Numbers with good margin expansions.

Now debt free.

17th May results come out.

Cadsys Ltd

Breakout done with huge volumes on the weekly.

Order book of around 540 Cr.

5 Year sales growth is 31 %

Low PE - 23.1

Sarla Performance Fibers Ltd.

Highest EVER weekly volumes since listed, followed by multi year breakout.

Great Q4FY24 results with

Q4 PAT 11 Cr vs 9 Cr YoY

Q3 PAT of 0.3 Cr

Sales are up 52% YoY and also EBIDT up 87% YoY.

Heritage Foods Ltd.

Breakout with good spike in volumes.

Great Q3FY24 Performance with good margin expansions in QoQ and YoY.

PAT is 2x YoY. 27 Cr vs 13.7 Cr, Q2 at 22 Cr.

Revenue at 942 Cr vs 786 Cr.

16th May Results come out.

TVS Holdings Ltd.

Gap up of around 6% on a weekly candle and close with high volumes building.

Great FY24 performance YoY.

Sales are up 19%

EBIDT up 34%

PAT is up 58%

EPS is up 51%

TVS holding also to acquire 80.74% stake in Home Credit India for 554 Cr.

Alkem Laboratories Ltd.

Good strength in price on weekly supported by Volumes.

Career Point Ltd.

Great strength in price although market is weak.

Great results as show below -

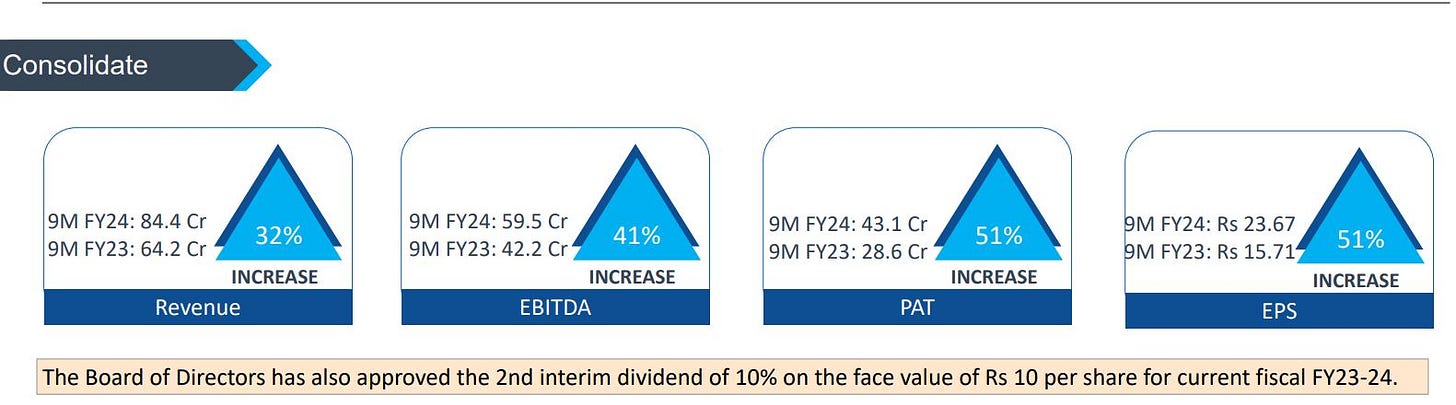

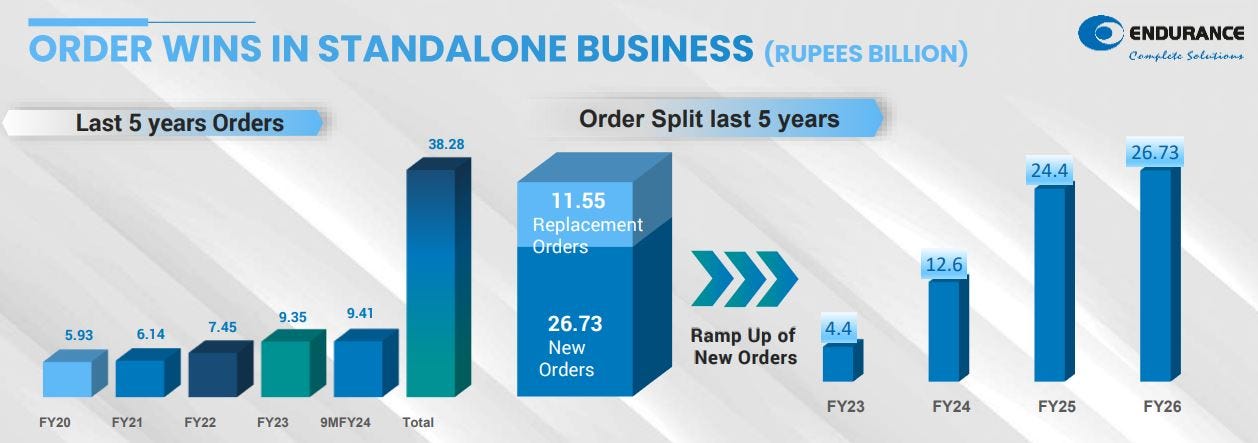

Endurance Technologies Ltd.

Beautiful breakout from the resistance supported by high volumes.

Order book of European Business is 249 million euros.

Revenue is up 22.7% YoY

EBITDA is up 29.9 % YoY

PAT is up 40.7% YoY

16th May Results come out.

DISCLAIMER : Please note the above is not a Buy/Sell recommendation, it is purely for just knowledge purposes and understanding Technical analysis and the behavior of the market. This newsletter is by no means is to give you calls or recommendations of any kind. Please learn from the above analysis and don’t copy trade. We are not SEBI registered nor a financial advisor. Thank you. Will be updating weekly on the performance of the stocks given in the previous week and prior to that, starting this week.

Make sure to read it till the end to keep track of performance of given stocks.

If you enjoyed reading this, learnt something and have any feedback or insights, please share by leaving a comment below 👇

Thank you for reading and keep learning.

Cheers,

Arjun.

Disclaimer : Content shared on or through this article is for information and education purposes only and should not be treated as investment or trading advice. The analysis and insights presented are based on publicly available information, and while efforts have been made to ensure accuracy, we cannot guarantee the completeness or reliability of the information.

Please do your own analysis or take consultation with a qualified financial advisor before making any investments based on your own personal circumstances.

Investment in securities are subject to market risks, please carry out your due diligence before investing. And last but not the least, past performance is not indicative of future returns.

The author of this post and the platform on which it is published do not provide personalized investment recommendations or financial advisory services. Any investment or trading decisions you make based on the information provided in this post are solely at your own risk.

Neither the author nor the platform shall be held responsible or liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this post. Readers are encouraged to conduct their own due diligence and seek professional advice before making any investment decisions.

By accessing and reading this post, you acknowledge and agree to the terms and conditions outlined in this disclaimer.

Subscribe to Contrarian Portfolio

Deep dive analysis on Indian & US listed stocks, Outlook of the market scenario, Research and Analysis on my picks.